Pay less for your house

Interest on your mortgage is simple interest, meaning that your interest is not compounded, or cannot gain interest on itself. Still, by making a larger down payment, you effectively reduce the amount you will ultimately pay for the home.

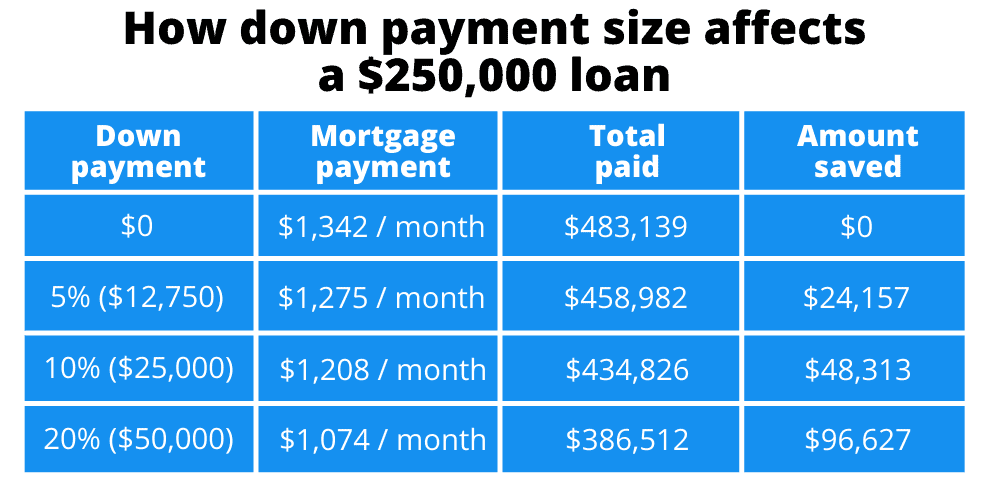

The following example uses and shows how putting different amounts down can lower your overall payment for your home, assuming a $250,000 loan. In the example below, we use a 30-year fixed-rate loan of 5%.

Down payment interest savings example

Taking out a loan for $250,000 would leave you with a mortgage-only payment of $1,342 per month. Over the life of that loan, if you paid your mortgage on time and put nothing else toward the loan’s principal, you would end up paying $483,139.

We will now run the numbers with a 5%, 10%, and 20% down payment.

Depending on which down payment you make, you would save $24,157, $48,313, or $96,627, respectively. That is almost a 100% return on your investment.

Lower your interest rate

Lenders are more likely to give you a better interest rate when you put down 20% compared to 5%.

Reduce your monthly mortgage payment

It doesn’t take a math whiz to realize that you will be required to pay less each month by lowering the total loan amount and paying less interest. When comparing a 5% and 20% down payment on a $200,000 home, you can easily see that the higher down payment lowers your monthly mortgage significantly.

Higher chance of offer being accepted

This one may be a little more mythical than numerical, but it still carries weight. When faced with the decision between two offers on their home, where the only difference is the amount of the down payment, a seller is much more likely to choose the offer with the higher down payment. This is because the buyer putting down more looks more credible in the seller’s eyes and is less likely to have problems throughout the loan process.

This is even more true when looking to purchase a home in a competitive market at a competitive price point.

Pros of making a smaller down payment

Get into a home faster

Saving is difficult. It can be very slow-going and painful.

When you are trying to purchase a home, the last thing you want to do is wait years and years to build up enough in a savings account for a large down payment. By putting less down, you will be able to get into a home more quickly.

Leave more in savings as an emergency fund

All things being equal, by putting less money toward your down payment, you will be able to keep more in your savings account. This means that if anything were to happen to your income stream, you wouldn’t be as at-risk of defaulting on your home loan.